LLMs, Bitcoin and Nvidia - Unraveling the Hype

How Nvidia Accidentally Fueled Crypto Mania and Got Burned by Its Own Success

GPUs, crypto, blockchains, and why LLMs make Jensen Huang smile like a cat that just found a mountain of HBM (that’s High Bandwidth Memory, aka the juiciest steak in tech) - This article is a collaboration with AI and Blockchain expert

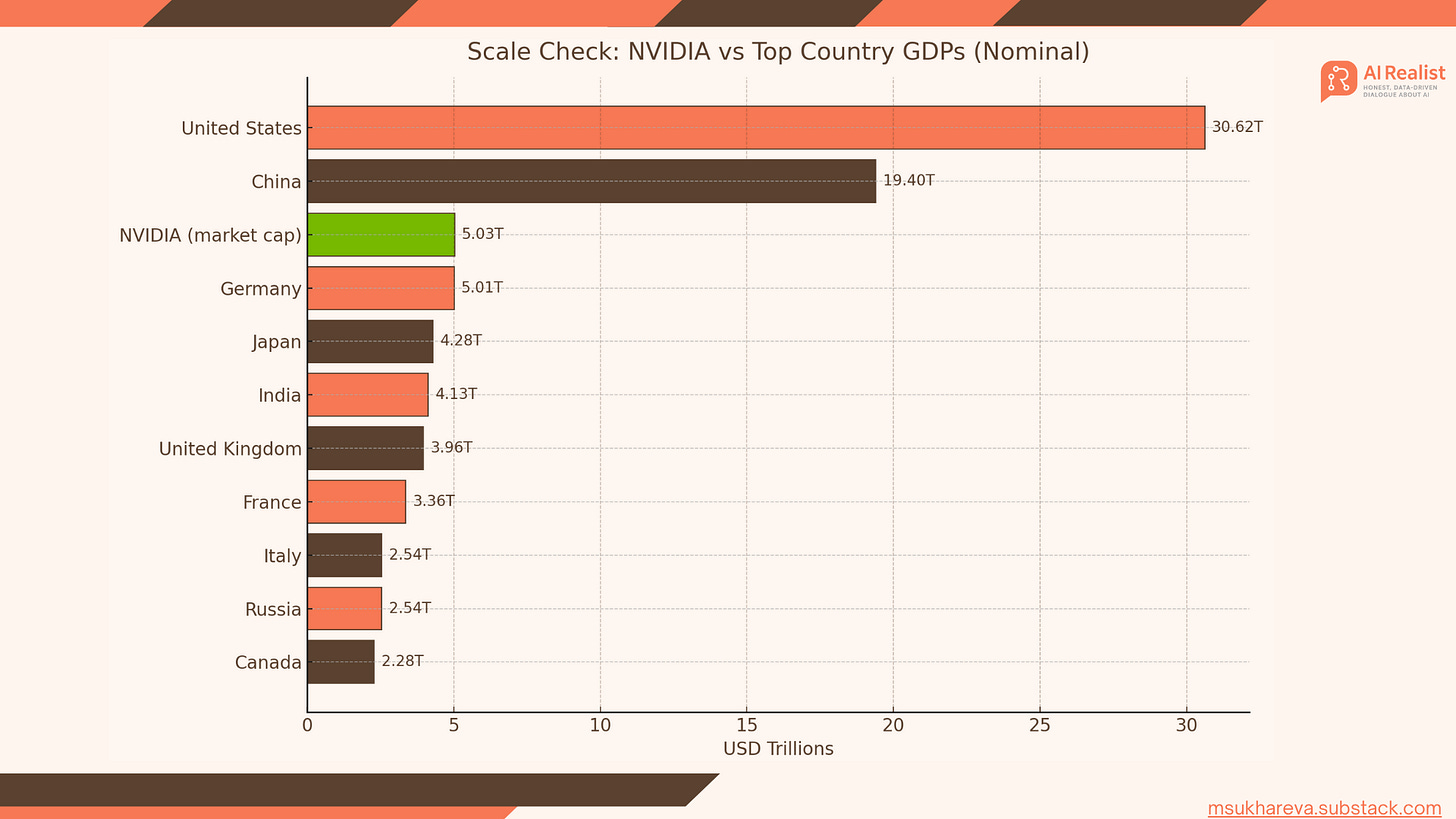

from Blockchain meets AI . Olga has a PhD and engineering degree; she led a real-world Web3 use case in tax and customs area. She is a Blockchain Evangelist and AI enthusiast. Blockchain meets AI explores how these two breakthrough technologies complement each other.Nvidia is all over the headlines: striking multi-billion-dollar data-center deals with OpenAI and deep cloud partnerships with AWS and Microsoft Azure. Its market cap is now about $5 trillion—more than the GDP of every country except the United States and China.

How many times have you heard that NVIDIA’s stock price is driven solely by crypto? But is that really true? Spoiler: It’s not ! It is a common myth that Nvidia’s skyrocketing stock price is all thanks to crypto miners. The real story is more nuanced: a mix of luck, a $5.5 million SEC settlement, temporary advantages, and a massive pivot to AI, leaving blockchain far behind for NVIDIA. Let’s separate fact from fiction and focus on what happened and how Nvidia arguably became the most important company on the planet.

What role Nvidia played in Crypto?

This is just the most chaotic, profitable, and controversial chapter in tech history. Nvidia didn’t set out to conquer crypto, they just tripped into it.

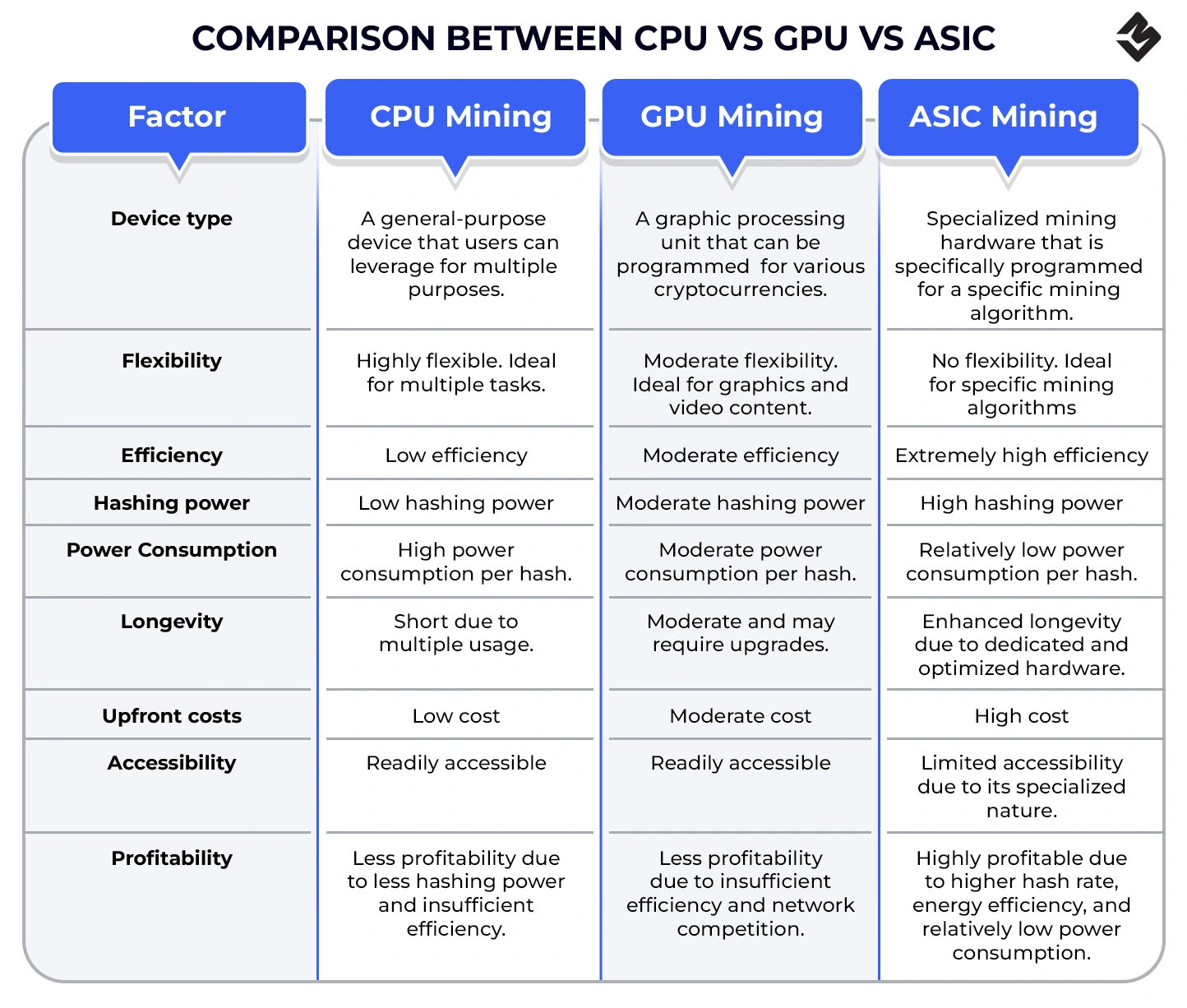

When Bitcoin and other cryptocurrencies have got more attractive, miners realized something game-changing: NVIDIA’s powerful GPUs weren’t just for gaming they were perfect for cracking the complex math puzzles required for “proof-of-work” mining than traditional CPUs. Early 2010s, the performance of GeForce GTX and RTX series GPUs, built for gaming, became the gold standard for crypto mining.

Why? Because they could solve complex cryptographic puzzles required to validate transactions and add blocks to the blockchain 10-100x faster than CPUs, thanks to their high hash rates and parallel processing superpowers. NVIDIA wasn’t alone as AMD’s Radeon cards were fierce competitors, often winning on raw hash power and cost.

The Crypto Hangover: When Success Bites Back

The crypto craze wasn’t all champagne and profits. By 2020, Nvidia faced a full-blown crisis. Miners hoarded every RTX 3080, leaving gamers furious and retailers empty. Social media was a warzone - #NvidiaHate trended as kids couldn’t play Cyberpunk 2077. Operations took a hit too: Nvidia’s supply chain couldn’t keep up, and their “gaming-first” brand was tarnished. To protect its core gaming market, Nvidia introduced hash rate limiters (LHR) on RTX 30-series cards starting in 2021, capping Ethereum mining efficiency by ~50%. With another words: NVIDIA took anti-mining measures! Miners just found workarounds.

Then, in response to demand, Nvidia launched CMP (Cryptocurrency Mining Processor) including models like the CMP 170HX. These were optimized for mining (e.g., no display outputs, better thermal design for 24/7 use) and sold exclusively through partners, allowing pros to mine efficiently without competing with gamers. The CMP line symbolized crypto’s shift from “freedom tech” to “infrastructure business.” Again the story repeats: the garage libertarian replaced by the industrial miner. You will say, now on industrial level it should be success. Unfortunately this smart move was too late! Why? Let see:

From GPU “gold standard” and “Renaissance” to the end of the era

Let us explain why the smart move of NVIDIA was too late.

GPUs weren’t always the best way to mine crypto. By 2013, a new technology surpassed them by a wide margin in speed and efficiency:

The GPU Gold Rush was made by Bitcoin miners in 2010–2013. Forums like BitcoinTalk were flooded with GPU rig setups, with NVIDIA’s cards battling AMD’s Radeon series (like the legendary HD 5970, which could hit ~800 MH/s for under $500). The end of an era came by 2013 when ASICs (Application-Specific Integrated Circuits) arrived, delivering 100–1000x the hash power of GPUs at a fraction of the energy cost. Suddenly, GPUs were obsolete for Bitcoin mining. First Ouch.

The GPU Renaissance happens thanks to Ethereum in 2015–2022. When Ethereum launched, its mining algorithm (Ethash) was GPU-friendly by design, resisting ASIC dominance. NVIDIA’s GTX and RTX cards became the backbone of ETH mining, even as AMD’s RX series (like the 5700 XT) often led in cost-efficiency. During the 2017–2018 crypto frenzy, NVIDIA estimated that 20–30% of its gaming GPU sales were tied to mining. Remember, that in 2021 NVIDIA started anti-mining measures to keep miners from hoarding stock. Then came lounch on CMP in 2022 and in the same time Ethereum’s switch to Proof-of-Stake, which killed GPU mining overnight. Miners scrambled to smaller coins, but nothing matched ETH’s scale or profitability. The second Ouch!

Even worse, NVIDIA was left sitting on a $1 billion mountain of unsold cards.

And it is still not the end.. the next and really big Ouch:

Did NVIDIA cover up the Crypto Boom that fueled its gaming sales?

In May 2022, the SEC went after NVIDIA, accusing the chip giant of hiding just how much crypto was juicing its gaming GPU sales. Specifically, during 2018, NVIDIA reported strong growth in its gaming business but failed to disclose that a significant part of this growth came from GPUs being used for cryptomining, not just gaming. It turns out that a big chunk of those “gamers” were actually crypto miners.

Just omission? Interestingly, NVIDIA had openly discussed crypto’s impact elsewhere in its business, making it look like gaming revenue was safely insulated from the wild swings of the crypto market.

The SEC (U.S. Securities and Exchange Commission) called that misleading. As a result, NVIDIA agreed to pay a $5.5 million fine to settle the charges, without admitting the guilt or denying the findings. The message was clear: if you’re cashing in on hype from an emerging tech wave like crypto, you’d better be upfront about it. The Third Ouch.

Some clarification

Just to be clear: Crypto as mentioned Bitcoin, Etherium, altcoing, mining etc and blockchain are cousins, not twins.

Blockchain: A replicated, append-only ledger with consensus, more infrastructure.

Crypto: Assets/tokens living on blockchains + the surrounding economy (exchanges, DeFi).

You can do blockchain without launching a token/crypto; you can also trade tokens without caring how Merkle trees feel about it.

GPUs helped Bitcoin, Etherium era’s, but blockchain adoption is marching on in tokenization, payments, and industrial/IoT regardless of GPU cycles.

Why Deep Learning and LLMs Are Making NVIDIA Rich

Ten months ago, AI experts on LinkedIn were yelling “Nvidia is dead!”: DeepSeek published a state-of-the-art model that was comparable to the latest OpenAI models back then and it was trained efficiently on few GPUs. Nvidia’s stock even dipped for a moment. But now, ten months later, Nvidia’s valuation is $5 trillion.

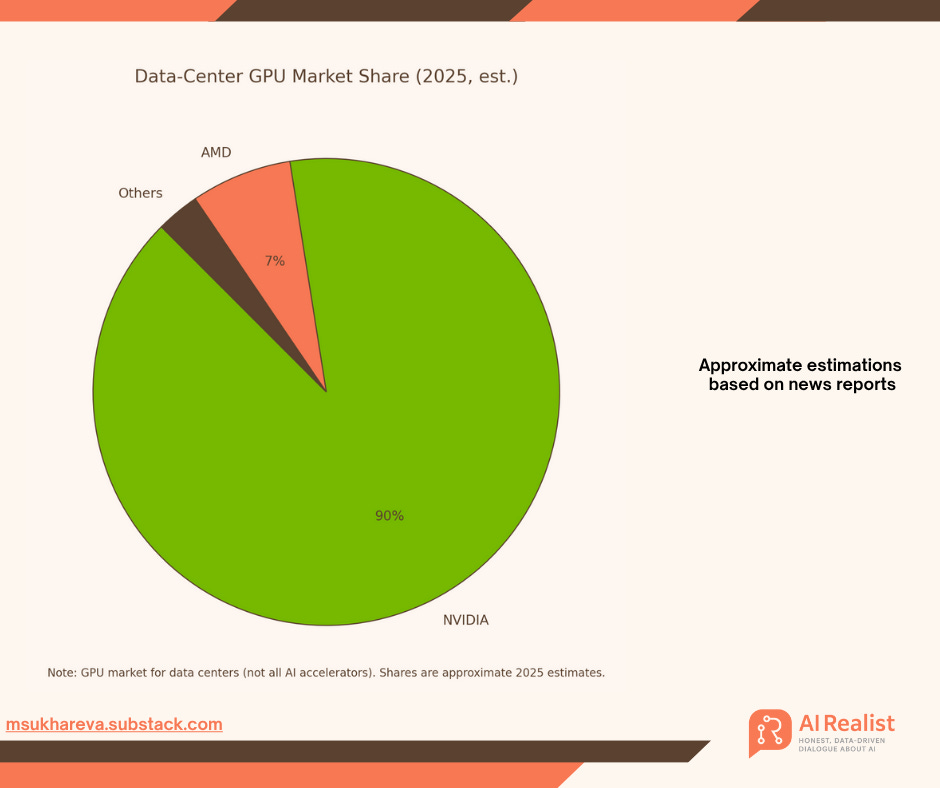

GPUs are not Nvidia’s moat. CUDA is.

CUDA, Not GPUs, Is the Moat

CUDA is the software layer that makes NVIDIA GPUs efficient for deep learning. Without CUDA, it’s extremely difficult to train and run modern AI models at scale.

All major frameworks (PyTorch, TensorFlow, MXNet) are deeply optimized for CUDA. Alternatives exist - ROCm (AMD) and Metal (Apple) - but they’re not at parity. They lag in inference performance, training stability, and support for fast low-precision math (FP16/BF16).

Translation: if you want your deep learning team to suffer, buy them anything that isn’t NVIDIA. If you want fast results, stable training, good inference, and a huge library ecosystem, you buy NVIDIA and you use CUDA. That is why almost everyone who does Deep Learning is after NVIDIA GPUs.

PTX Isn’t an Escape Hatch

“But DeepSeek did it without CUDA,” some might say. First, bravo to the researchers who pulled that off, but that path is not for everyone, and you really, really don’t want to redo it yourself.

It is simply because taking that path means: no more HuggingFace, no more PyTorch, no nice ecosystem. You rebuild everything from scratch. In a way - re-inventing the wheel, that was already created by Nvidia.

And even then, DeepSeek didn’t actually escape NVIDIA. They just went one level lower and wrote against PTX (basically the assembly layer for CUDA). PTX is still NVIDIA’s stack. They were still inside NVIDIA’s world.

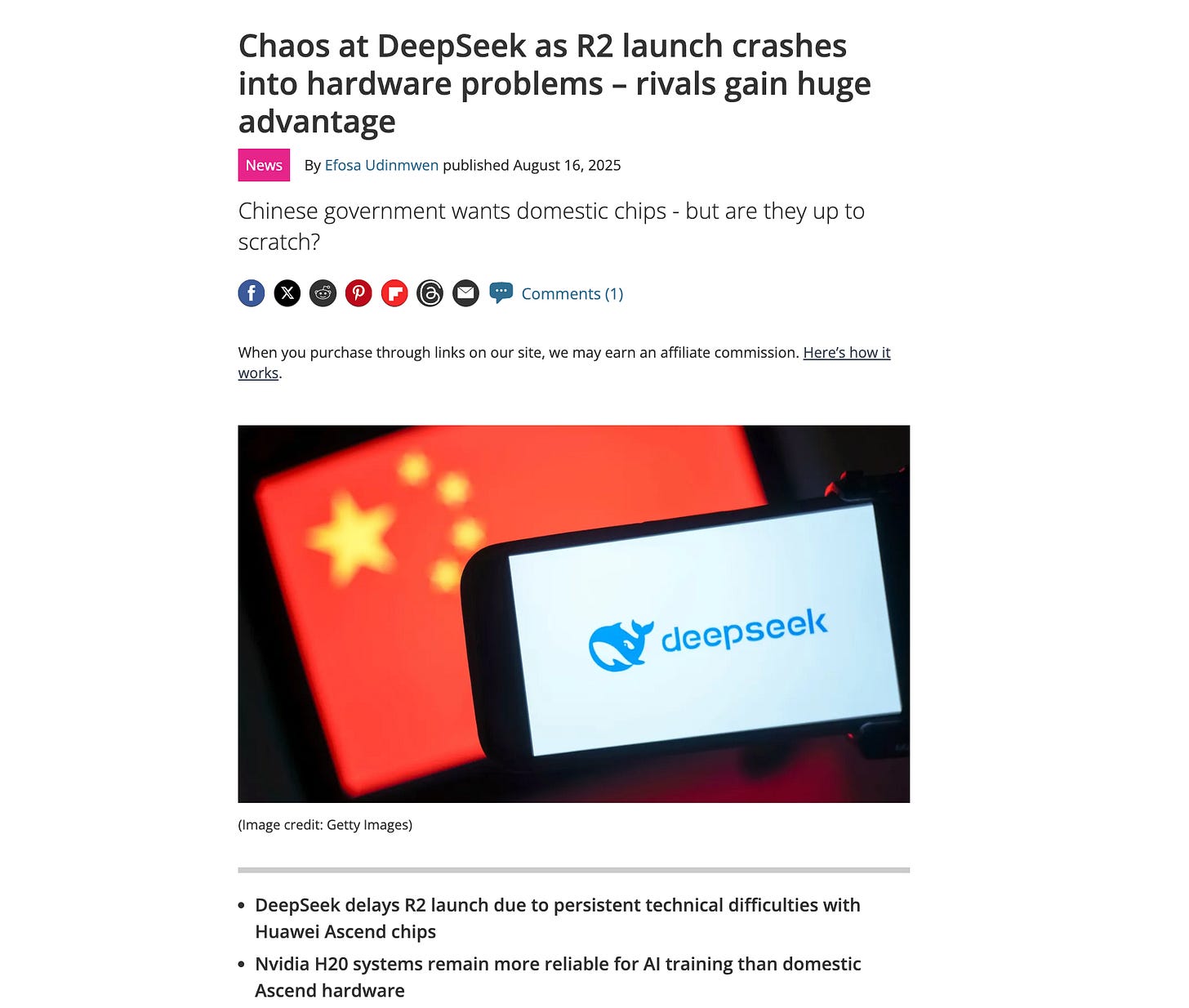

At some point, Chinese authorities, feeling “patriotic”, pressed DeepSeek to train the next generation of their models on Huawei Ascend rather than NVIDIA.

Long story short, after multiple unsuccessful training attempts on Ascend, the story hit the news: R2 stalled/delayed, with reports pointing to software, stability, interconnect, and ecosystem gaps.

Eventually they had to capitulate and go back to NVIDIA for training (while still exploring Ascend for some inference). This is how big the moat is: even brilliant Chinese researchers who managed to train a state-of-the-art model by dropping down to PTX (basically assembler inside NVIDIA’s stack), even with strong backing and a massive Chinese corporation, could not practically complete training away from NVIDIA at least for now.

Will Blockchain comeback?

When Maria put it into the article, I realized that after hype was over.. for everyone who is not dealing with this technology the impression is that blockchain has disappeared. But no, It never left. I must say, it just changed clothes. Less “number go up,” more ZK scaling, tokenized assets, stablecoin rails, and enterprise (IoT/identity, supply chains). The GPU angle re-enters mainly via ZK proving and AI×crypto intersections (decentralized compute marketplaces). Actually I think the chapter should be named as:

Where NVIDIA could POWER in blockchain?

While NVIDIA’s GPUs fueled the past, the future of blockchain might hinge on zero-knowledge proofs (ZKPs)—specifically zk-SNARKs and zk-STARKs. Here’s the simple breakdown:

What they do: ZKPs let you prove something is true without revealing any details. Imagine proving you know a password without saying what it is.

Why it matters: They make blockchains faster, cheaper, and more private. Ethereum and other chains are racing to adopt ZK tech for scaling and security.

NVIDIA’s potential role: GPUs (and even specialized AI chips) are perfect for the heavy math ZKPs require. If ZKPs become mainstream, NVIDIA’s hardware could power the next crypto revolution, just like it did with mining in the beginning.

The final thought

In summary NVIDIA was an Enabler, Not Mastermind for a Crypto, but they powered its wildest years and then got crushed by their own success.

Was NVIDIA’s stock “solely driven by crypto”? Not even close. Nvidia’s stock isn’t crypto’s puppet, contrary it is AI’s juggernaut.

And there are some parallells:

Back then, miners were building custom rigs.

Today, everyone’s building custom AI models.

Same energy. Same gold rush. Same blind spots.

Because every revolution, sooner or later, meets its own LHR limiter (remember? limit hash rate from NVIDIA againt miners?): in crypto, it was hash rate; in AI, it might just be energy, regulation, or ethics.

Lessons Learned (The Hard Way)

Unintended Markets Are a Trap: Nvidia didn’t ask to be crypto’s darling, but the demand nearly broke them. If your tech gets hijacked by a hype cycle, brace for chaos.

Supply Chains Aren’t Magic: GPU shortages showed Nvidia’s limits. Building for one market (gaming) doesn’t scale when another (crypto) takes over.

Hyperscalers Wait for No One: ASICs and cloud providers like AWS outpaced Nvidia’s crypto pivot. Your edge today is someone else’s lunch tomorrow.

Band-Aids Don’t Fix Tidal Waves: LHR and CMP were reactive fixes. By the time Nvidia acted, miners had moved on, and gamers were still mad.

Ego Hurts: Nvidia’s “we’ll handle it” attitude ignored how fast crypto evolved. Humility would’ve saved them some bruises.

If you liked this newsletter, consider upgrading your subscription or visiting the shop

Paid subscribers get:

Priority answers to your messages within 48-hours

Access to deep dives on the latest state-of-the-art in AI

Founding members receive even more:

A 45-minute one-on-one call with me

High-priority personal chat where I quickly reply to your questions within 24-hour

Support independent research and AI opinions that don’t follow to hype

— or check out the AI Realist Shop.

Every item you buy comes with a free month of paid subscription (two items = two months, and so on).

Your point about Nvidia fueling crypto excitement but then getting hit by its own supply issues is spo on. Inference workloads are moving closer to devices at the edge, so the demand for HBM and efficient GPUs won't just be about training in big datacenters. It's wild to see how blockchain hype piggybacked on AI announcements, but there are real synergies in using decentraliized compute networks for AI inference. I'm curios how regulatos will view these hybrid models as they mature. Thanks for connectng these dots.